In the last decade, smartphones have transformed from mere communication tools into powerful gateways to the digital world, fundamentally altering how people access information, connect with others, and go about daily life. As of 2025, over 6.9 billion people globally are estimated to use smartphones, a number that continues to grow rapidly. Alongside this surge, social media platforms have become embedded in everyday routines, with more than 5.1 billion active users worldwide, representing over 62% of the global population.

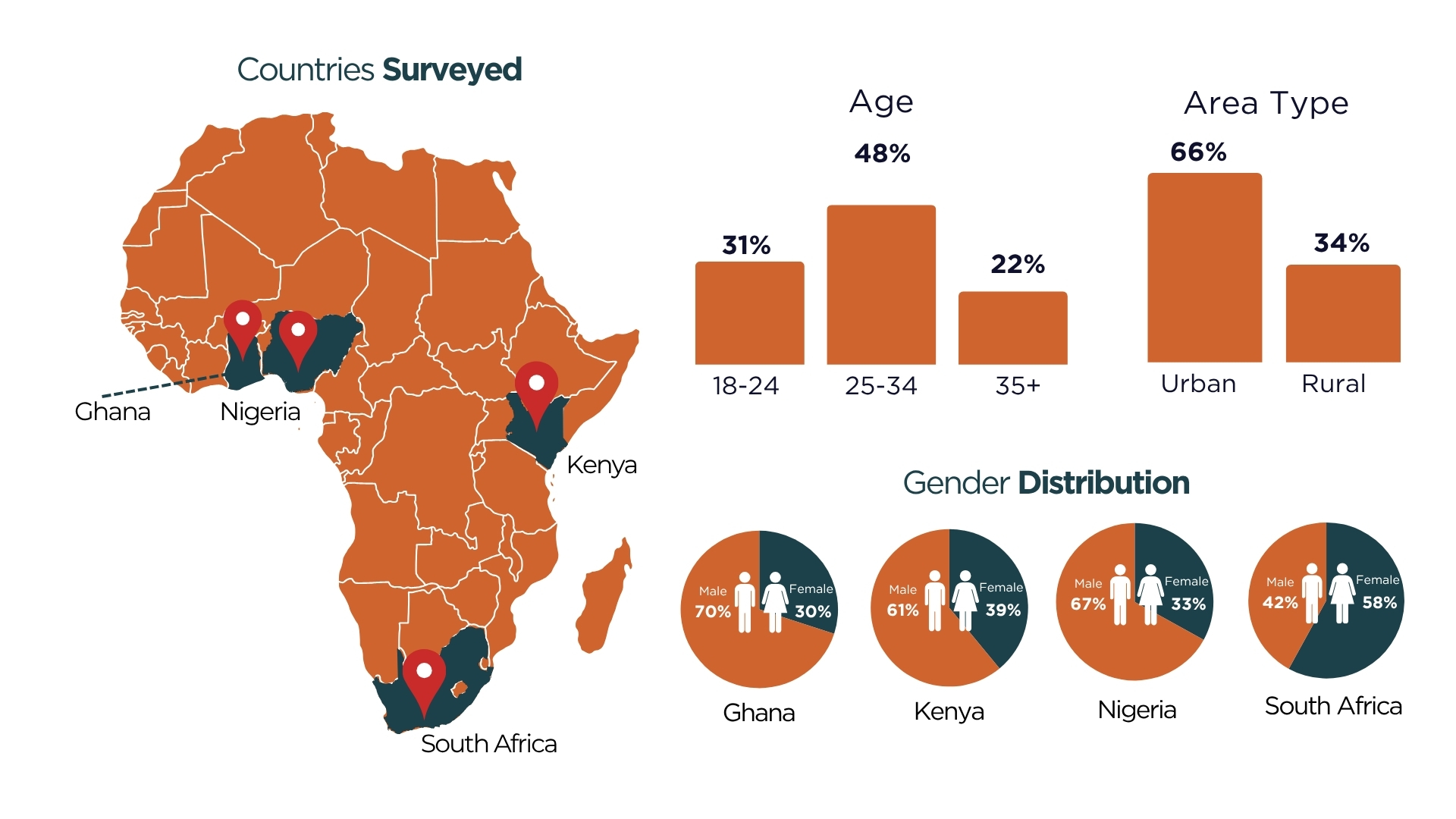

GeoPoll, powered by TuuCho; conducted the study in July 22nd to 25th via GeoPoll’s mobile web platform, reaching a total of 3,945 respondents across four African countries: Ghana, Kenya, Nigeria, and Uganda.

This report builds upon the insights presented in the 2023 Social Media Usage Trends in Africa, delving deeper into the evolving relationship between smartphone adoption and social media engagement across the continent; examining emerging patterns across demographics, regions, and cultural contexts.

At a glance

- Smartphones are the most used type of mobile phone with 98% of the respondents

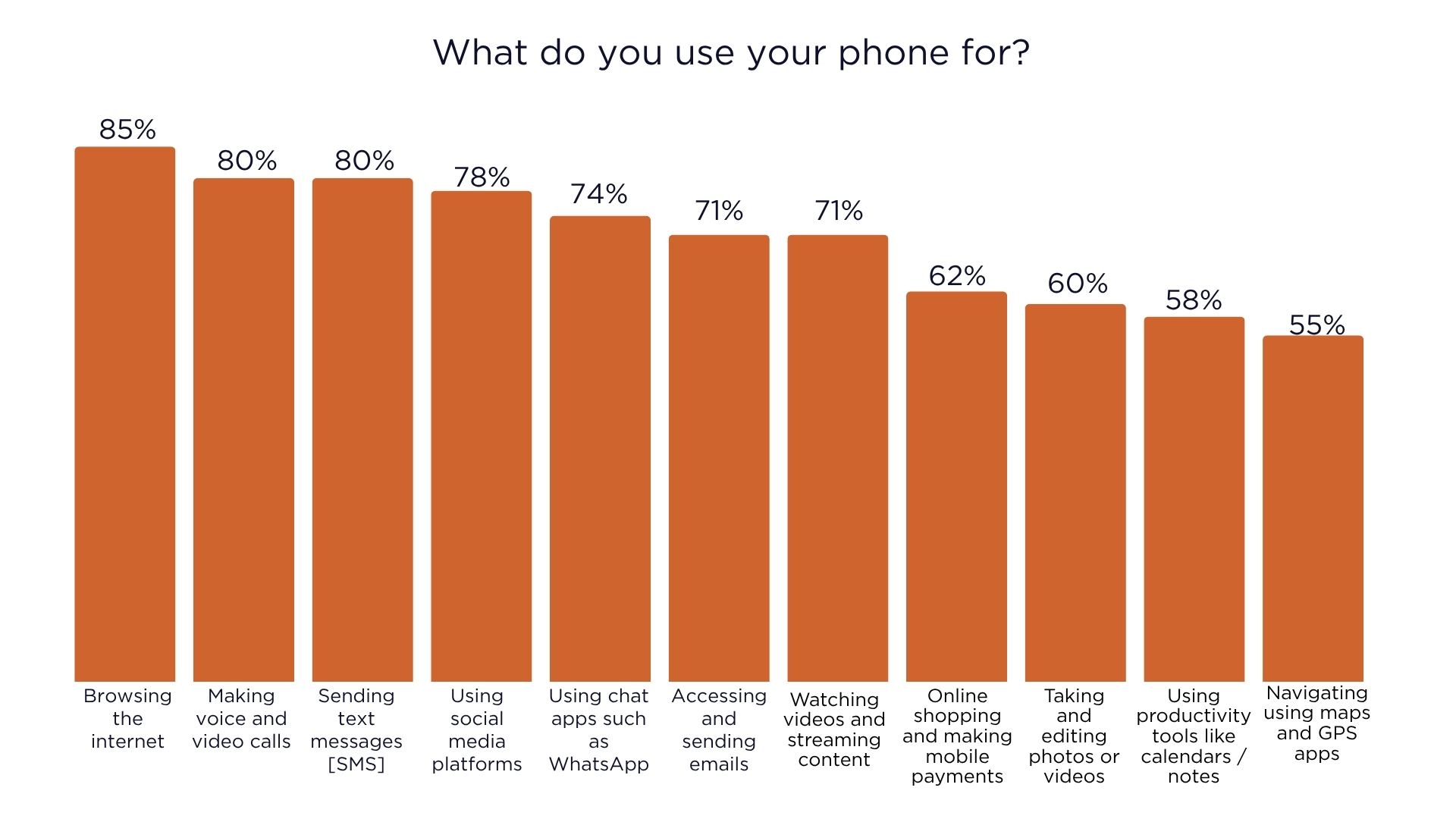

- Browsing the internet (85%), making voice and video calls (80%) sending text messages (79%) are the top phone usage.

- 98% of the respondents use social media.

- WhatsApp, Facebook and YouTube are the top social media platforms.

- Majority of the respondents (35%) spend 3-6hours per day on social media.

- 60% of respondents reported that social media has had a very positive impact on their overall well-being and mental health.

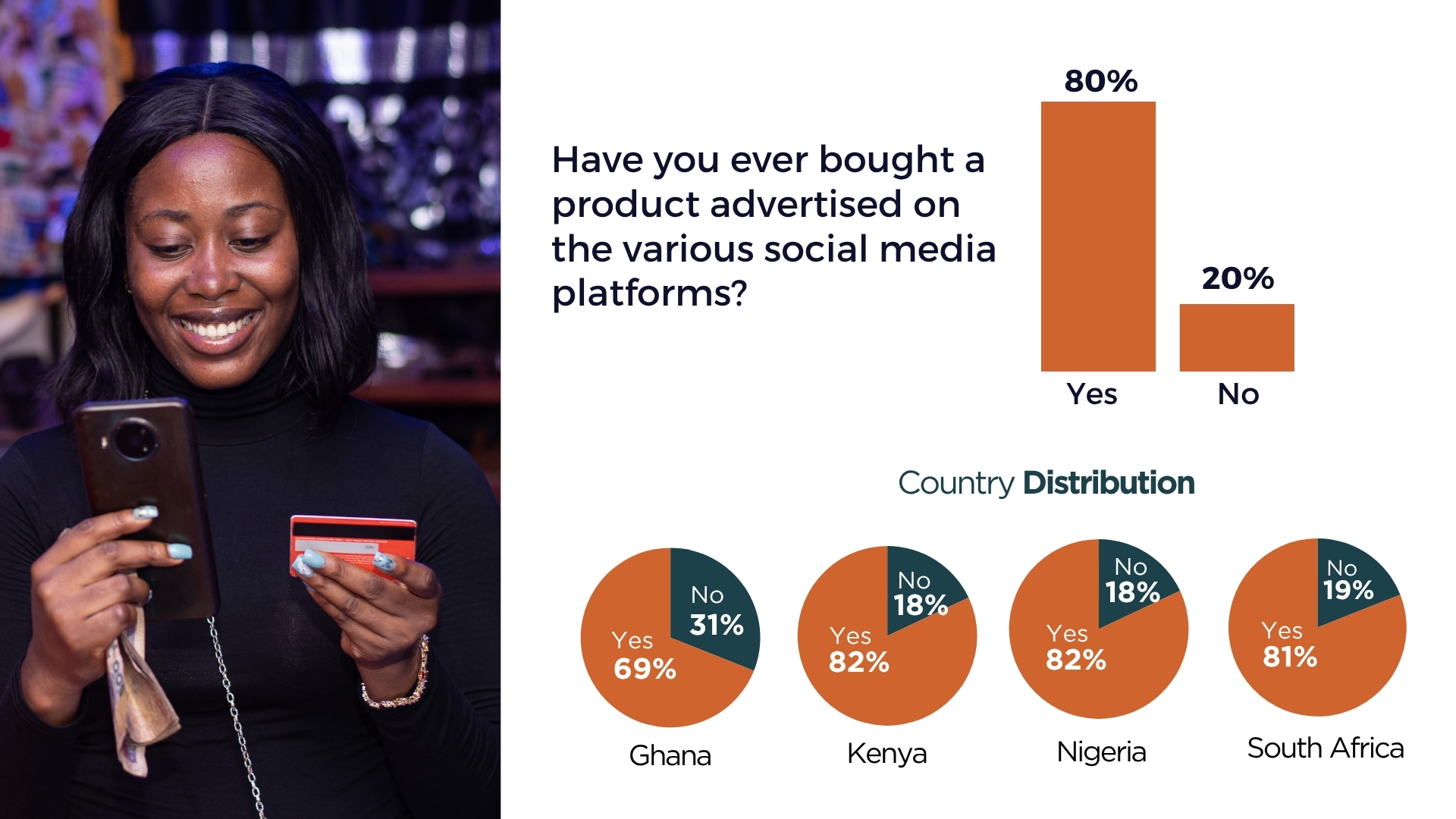

- Majority, 80% have ever bought a product advertised on the various social media platforms.

Demographic Overview

The survey gathered responses from a diverse group of young Africans from Ghana, Kenya, Nigeria and South Africa. Most respondents were aged 25-34 (48%), with a balanced representation of males (61%), and females (39%). Respondents were predominantly from urban (66%) and rural (34%) areas.

Mobile Phone Usage Insights

When asked about the type of phone they use most frequently, an overwhelming 98% of respondents reported using smartphones, while only 2% indicated they primarily use feature phones. Furthermore, 97% of respondents stated that they personally own

these phones. This is a high number, considering that , but considering the methodology used – mobile web – the audience is more affluent. Based on this methodology bias, one could say that 98% of the respondents using mobile phones use smartphones.

In terms of how phones are used, browsing the internet emerged as the top activity (85%), followed closely by making voice and video calls (80%), and sending text messages (SMS) (80%). Other common uses include accessing social media platforms (78%), using chat apps such as WhatsApp (74%), and sending or receiving emails (71%).

Top Social Media

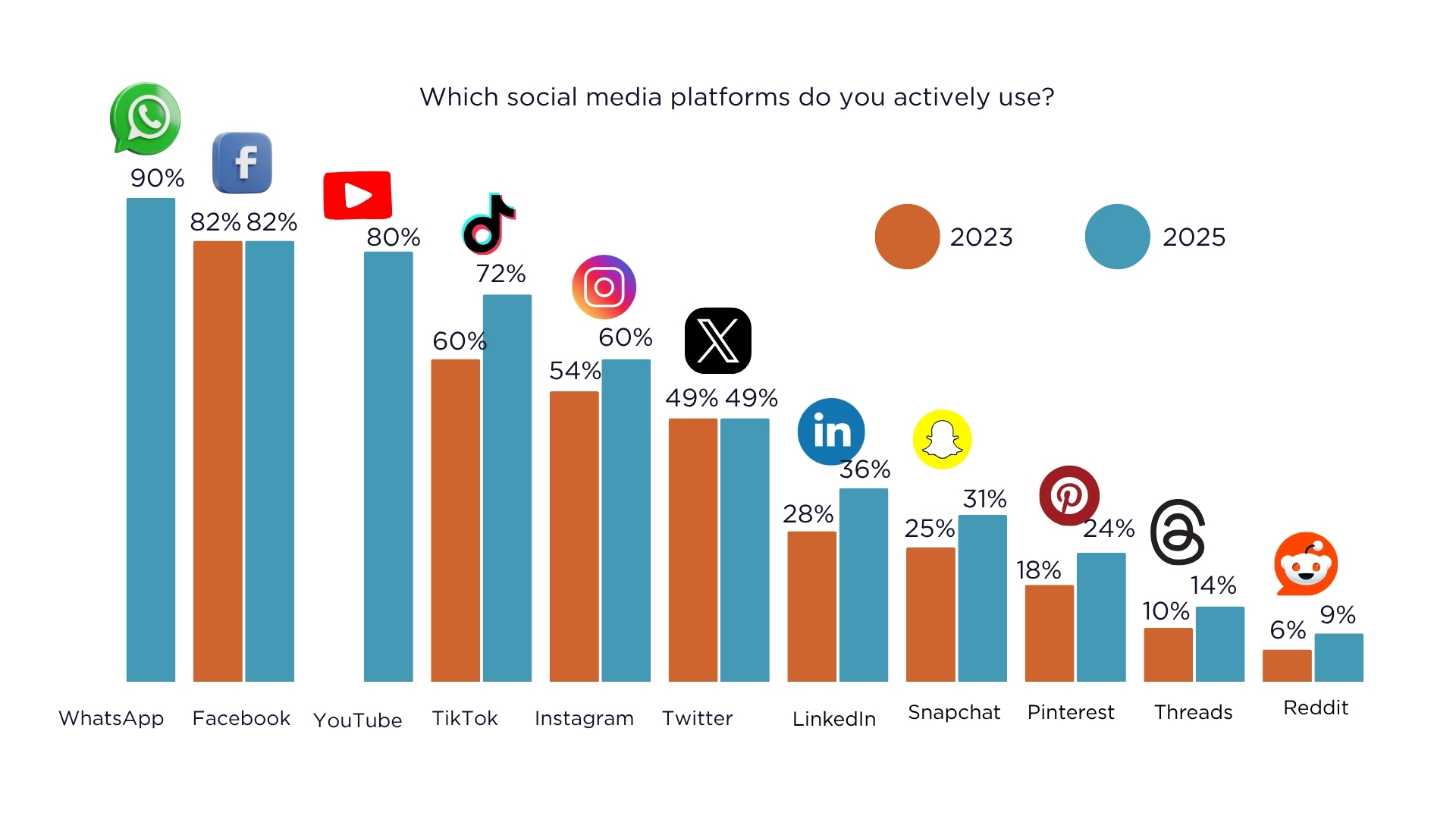

Between 2023 and 2025, social media usage in Africa has evolved from platform-specific engagement to near-universal adoption, with 98% of respondents in 2025 reporting active use. While Facebook maintained its dominant position with 82% usage in both years, WhatsApp surged ahead in 2025, becoming the most-used platform at 90%, highlighting a shift toward private messaging and real-time communication.

TikTok and Instagram also experienced notable growth, rising from 60% to 72% and 54% to 60% respectively, driven by their visual and interactive content formats. Meanwhile, Twitter/X remained stable at 49%. Platforms like LinkedIn, Snapchat, and Pinterest showed steady increases, reflecting growing interest in professional networking, ephemeral content, and inspiration-based media.

WhatsApp and YouTube were not covered in the 2023 data collection

Time spent

The survey reveals how users allocate their time on social media. The majority, accounting for 35%, spend between 3 to 6 hours daily on these platforms. Following closely, 31% of users engage for 1 to 3 hours. In addition, 20% of users report spending 6 to 9 hours on social media, while 9% dedicate 9 to 12 hours. A smaller segment, around 7%, spends more than half of their day on social media. This data highlights the significant amount of time many individuals invest in these online interactions.

Social Media Usage

The overwhelming majority of respondents (95%) primarily access social media from their phones, which highlights the dominance of mobile devices in digital engagement. In contrast, only a small percentage use tablets (3%) or computers (2%), emphasizing how convenient and ubiquitous smartphones have become as the go-to device for enjoying social media.

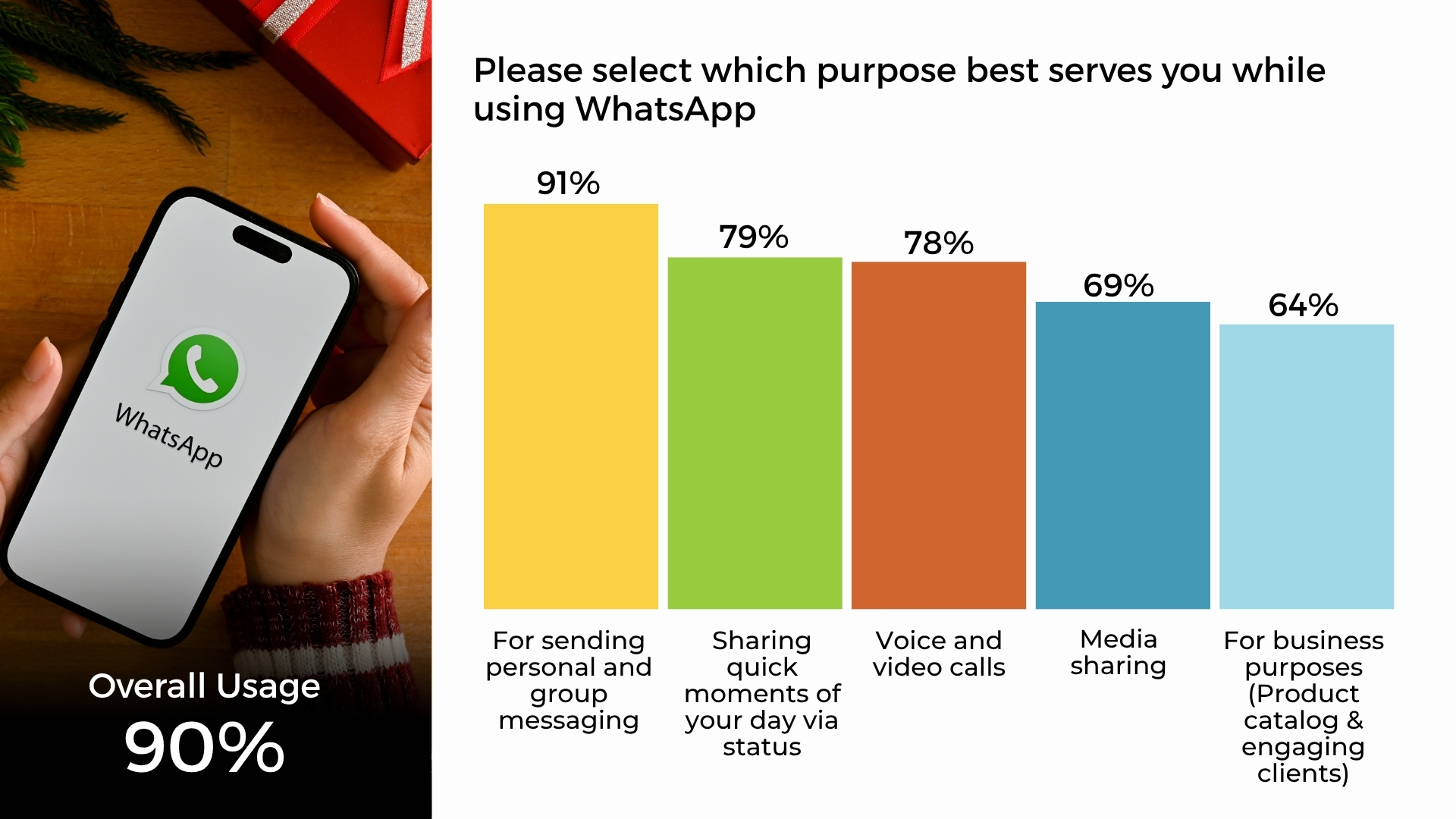

As part of the broader social media usage trends, WhatsApp stands out not only as the most widely used platform but also as one of the most versatile. The majority of respondents (91%) use WhatsApp primarily for personal and group messaging, reinforcing its role as a central tool for everyday communication. Additionally, 79% of users share daily moments via status updates, while 78% use it for voice and video calls, showcasing its multifunctional capabilities. Media sharing is also prevalent, with 69% of respondents engaging in this activity, and 64% report using WhatsApp for business purposes, such as showcasing product catalogs and interacting with clients. These findings highlight WhatsApp’s critical role across both personal and professional spheres in the evolving digital communication landscape.

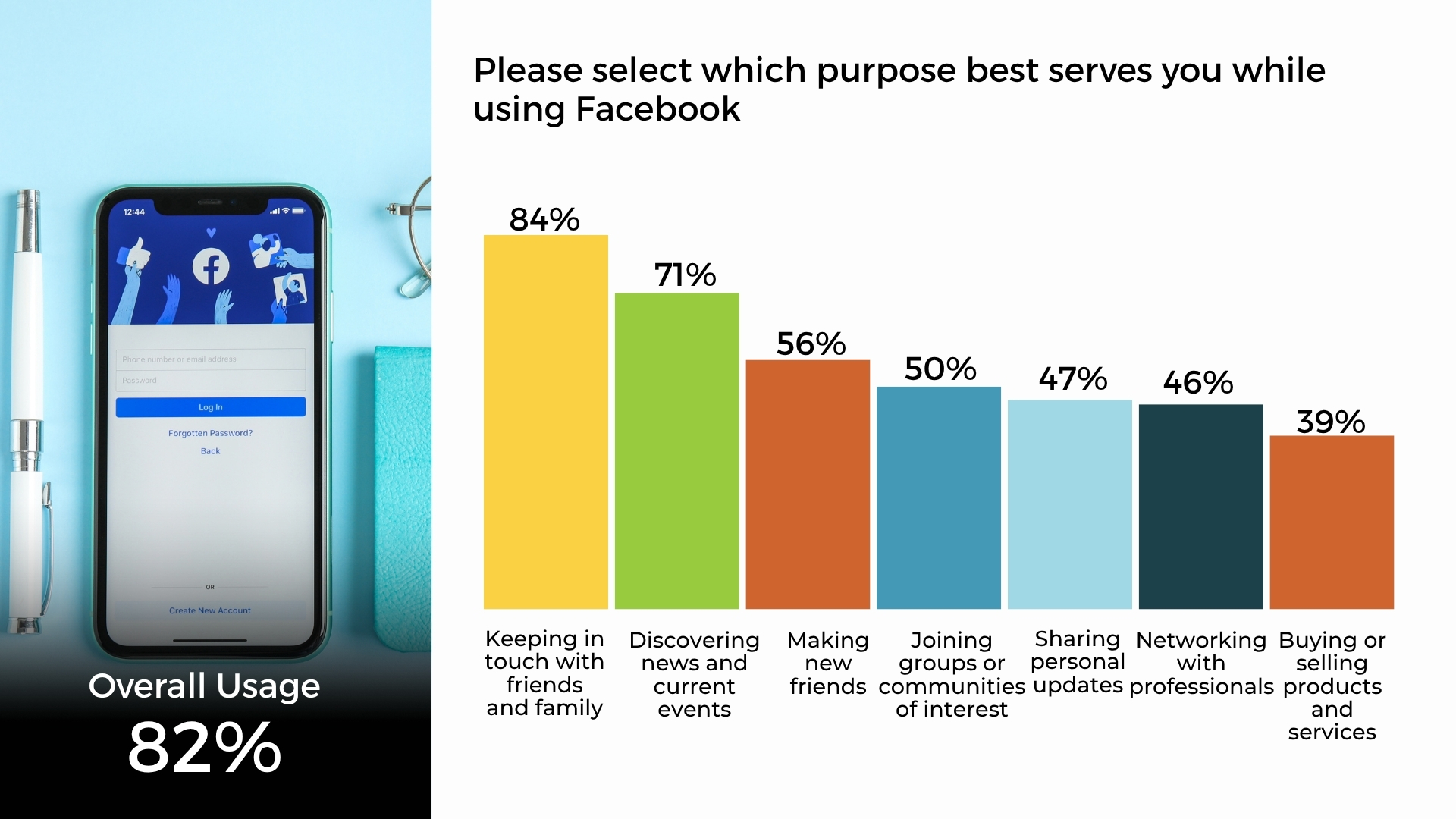

In the context of Facebook usage, the platform continues to serve as a vital hub for social connection and information. The majority of respondents (84%) use Facebook to keep in touch with friends and family, reaffirming its role as a cornerstone of digital social interaction. Beyond socializing, 71% of users rely on the platform to discover news and current events, highlighting its significance as a source of information. Facebook also plays a role in expanding social networks, with 56% using it to make new friends, and 49% joining groups or communities of interest. Other notable activities include sharing personal updates (47%), networking with professionals (46%), and buying or selling products and services (39%), underscoring the platform’s diverse utility that spans personal, social, and economic engagement.

YouTube

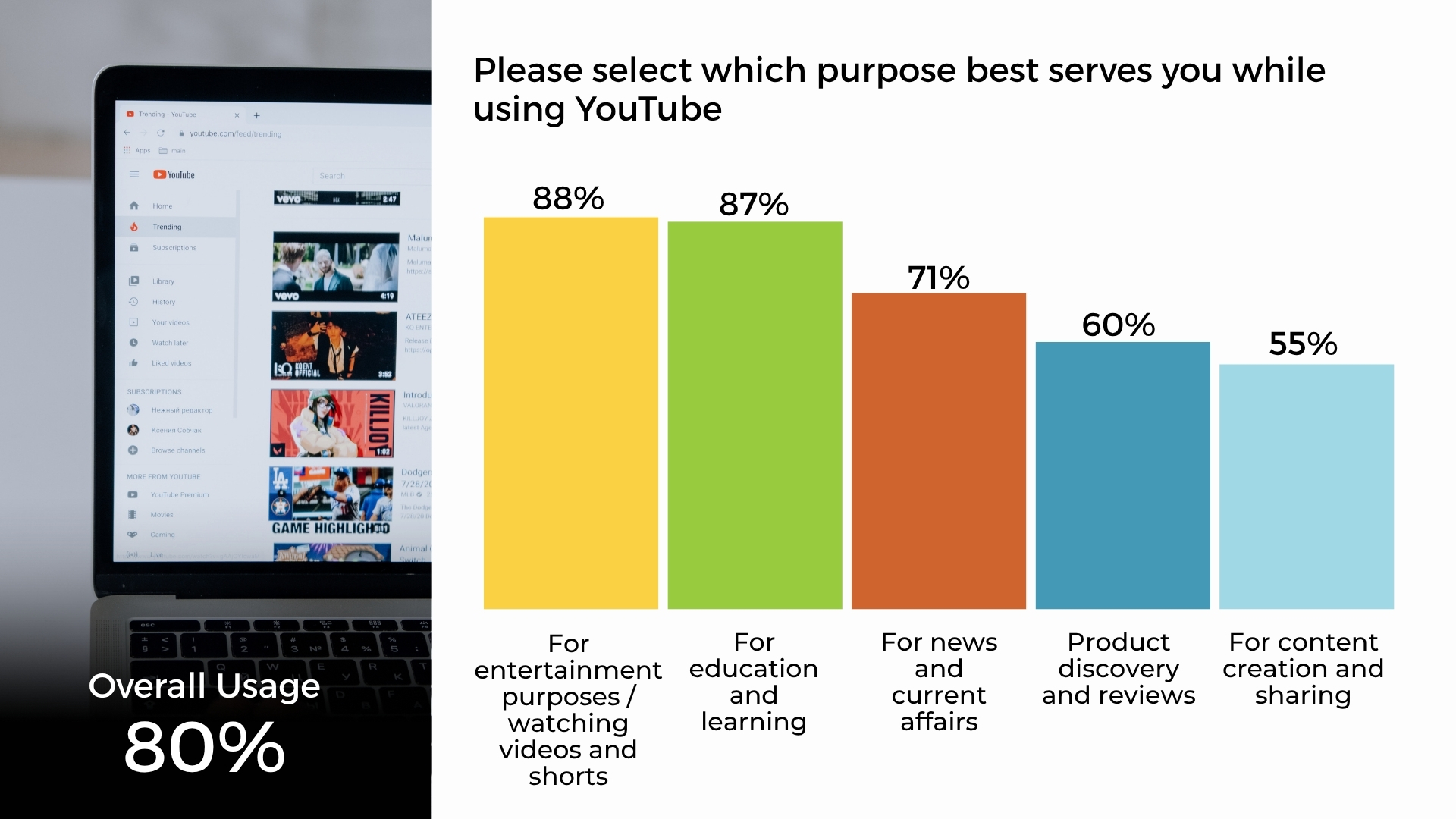

YouTube remains a leading platform with diverse use cases. About 88% of users engage with it for entertainment, mainly watching videos and shorts. Additionally, 87% utilize it for educational content like tutorials, while 71% turn to it for news and current affairs. Other activities include product discovery and reviews at 60%, and content creation and sharing at 55%, showcasing its role in both passive and interactive engagement.

TikTok

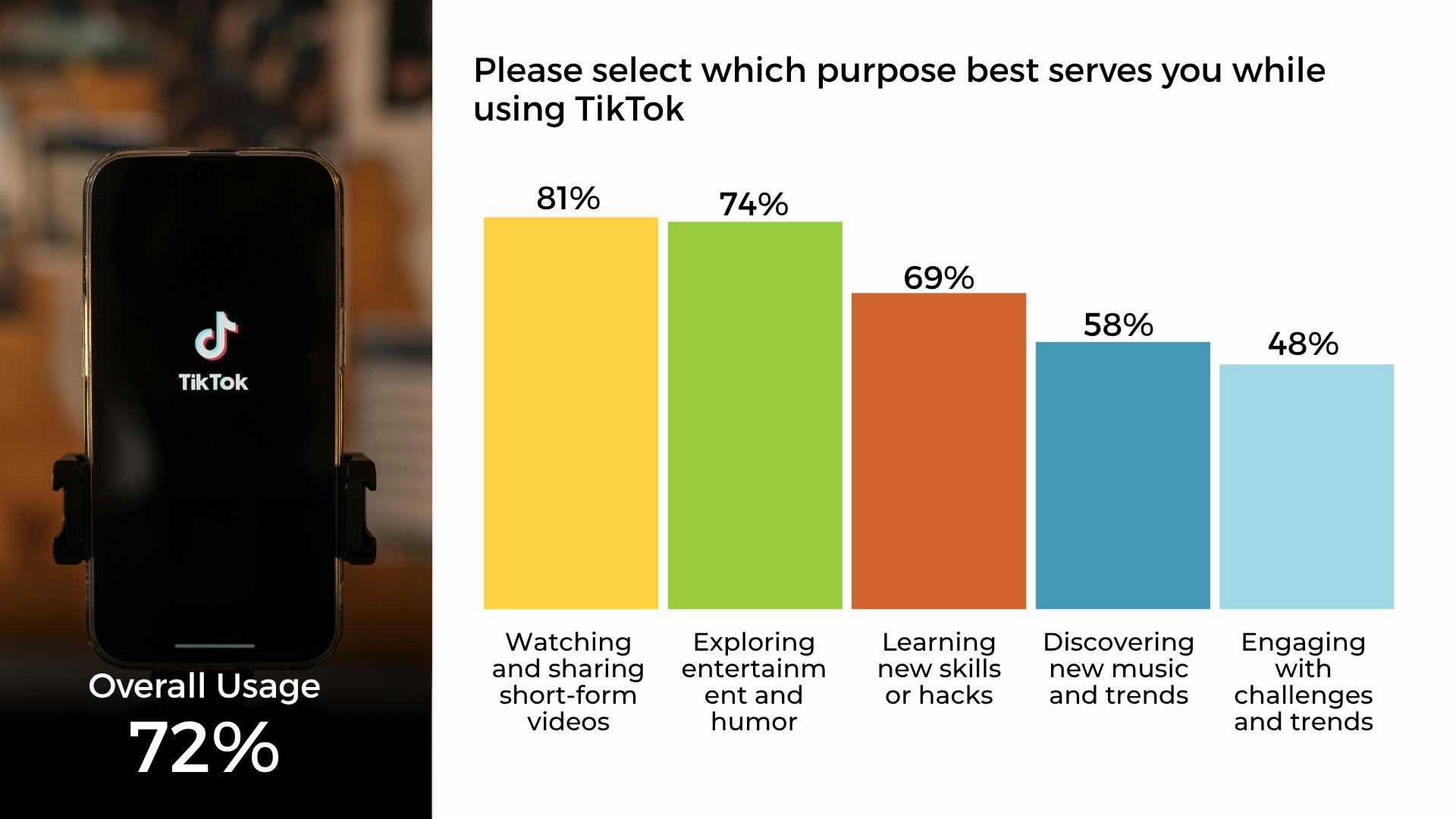

TikTok continues to thrive as a hub for short-form, engaging content, with 81% of users watching and sharing videos as their primary activity. It is also a major source of entertainment and humor for 74% of respondents, while 69% use it to learn new skills or hacks, showcasing its growing role in informal education. Additionally, 58% turn to TikTok to discover new music and trends, and 48% engage with viral challenges, reflecting the platform’s influence on pop culture and digital creativity.

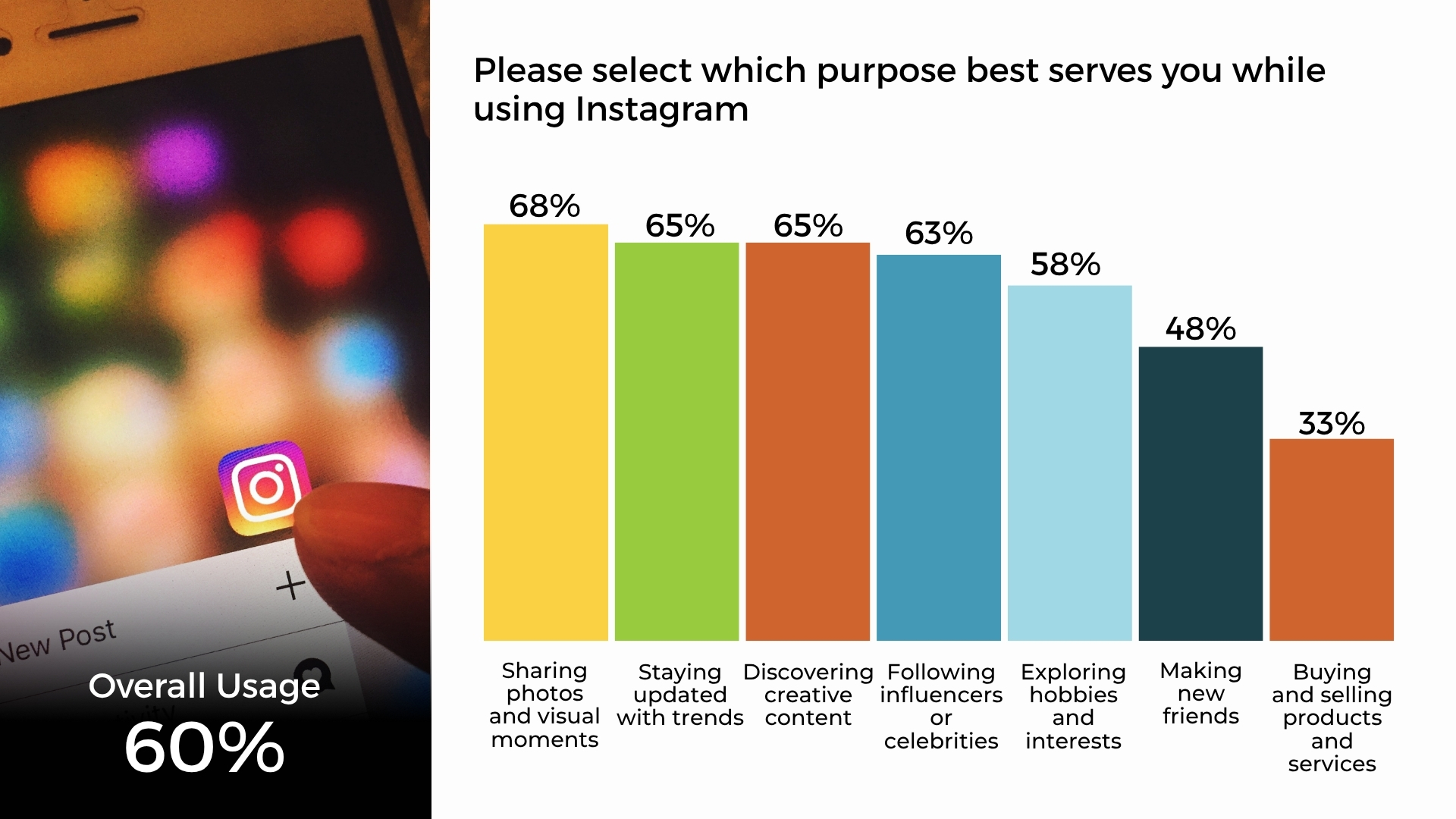

Instagram remains a highly visual and trend-driven platform, with 68% of users using it to share photos and visual moments. It is also widely used for staying updated with trends (65%) and discovering creative content (65%), reinforcing its appeal to visually-oriented users. Additionally, 63% follow influencers or celebrities, and 58% explore hobbies and interests, showing Instagram’s role in both inspiration and lifestyle content. Social interaction is still present, with 48% using it to make new friends, while 33% engage in buying and selling products and services, highlighting its growing role in social commerce.

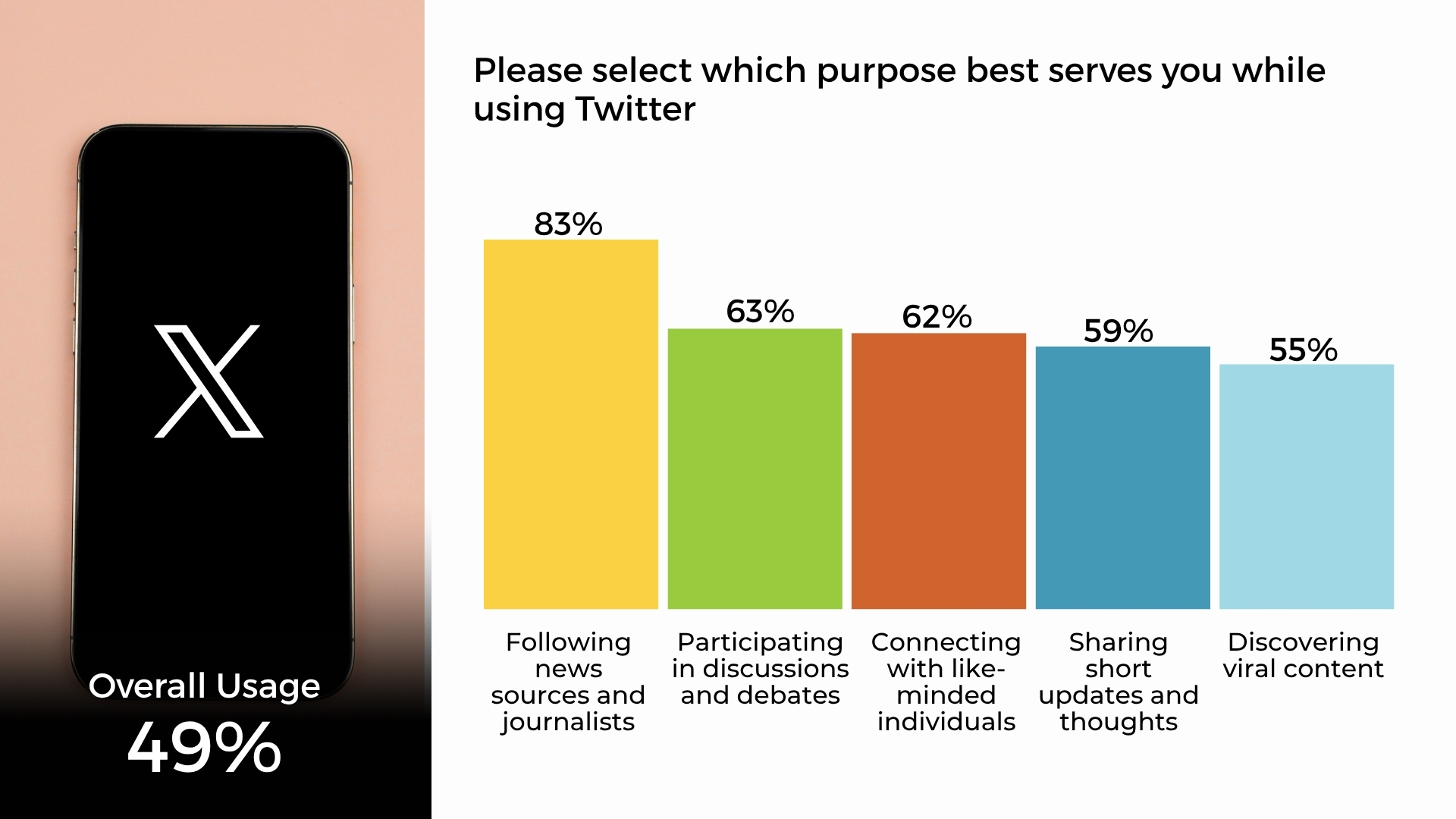

Twitter (X)

Twitter (now X) continues to be a key platform for real-time information and conversation. A dominant 83% of users rely on it for following news sources and journalists, making it the top platform for staying informed. Additionally, 63% use it to participate in discussions and debates, while another 62% connect with like-minded individuals. 59% engage by sharing short updates and thoughts, and 55% use it to discover viral content, reflecting Twitter’s dynamic role in shaping public dialogue and trending topics.

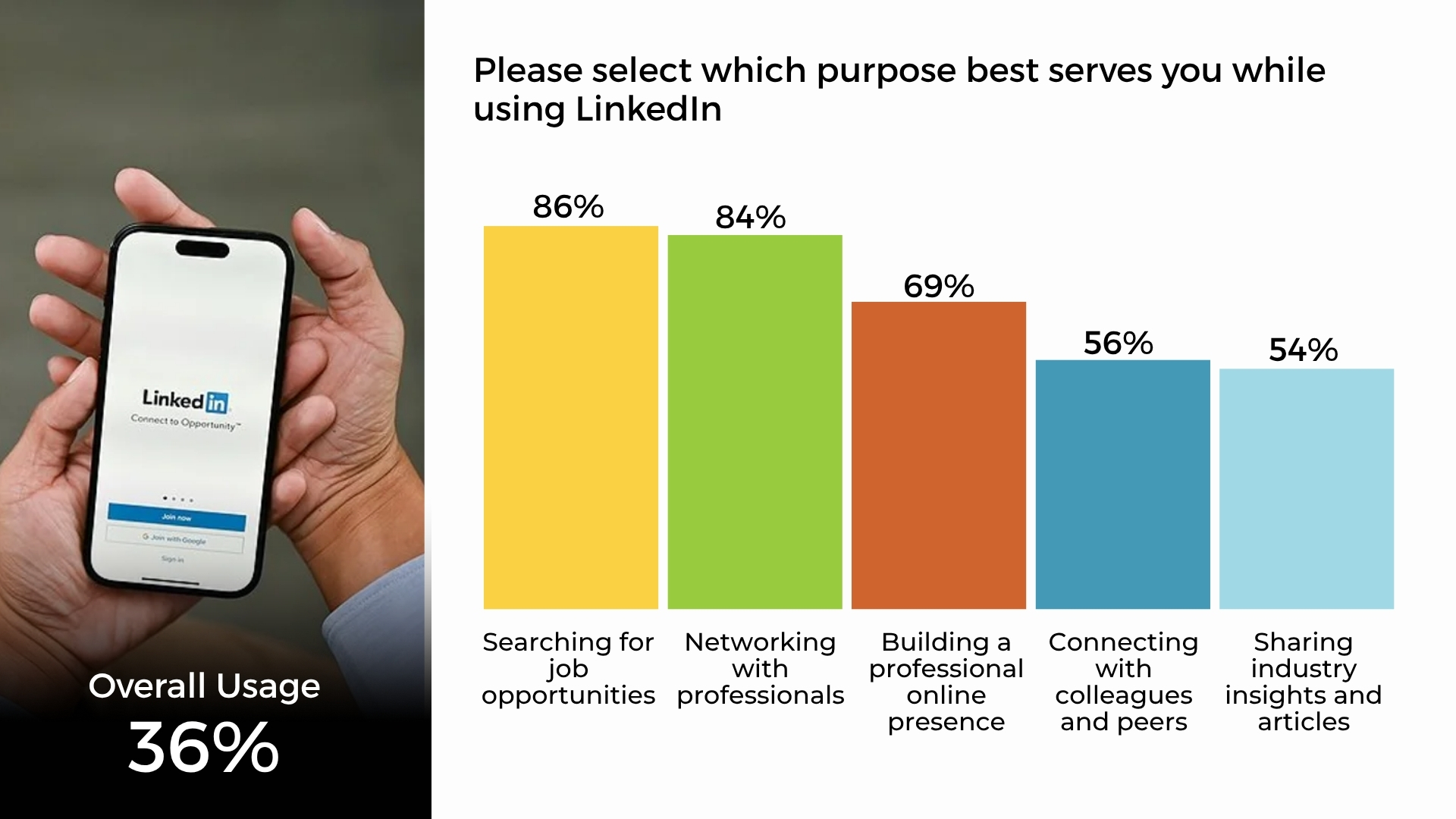

LinkedIn stands out as a leading platform for professional development and career growth. A significant 86% of users utilize it for searching job opportunities, while 83% use it for networking with professionals, emphasizing its role in career advancement. Additionally, 69% focus on building a professional online presence, and 56% connect with colleagues and peers. Over half (54%) also use LinkedIn to share industry insights and articles, highlighting its importance as a hub for knowledge exchange and professional engagement.

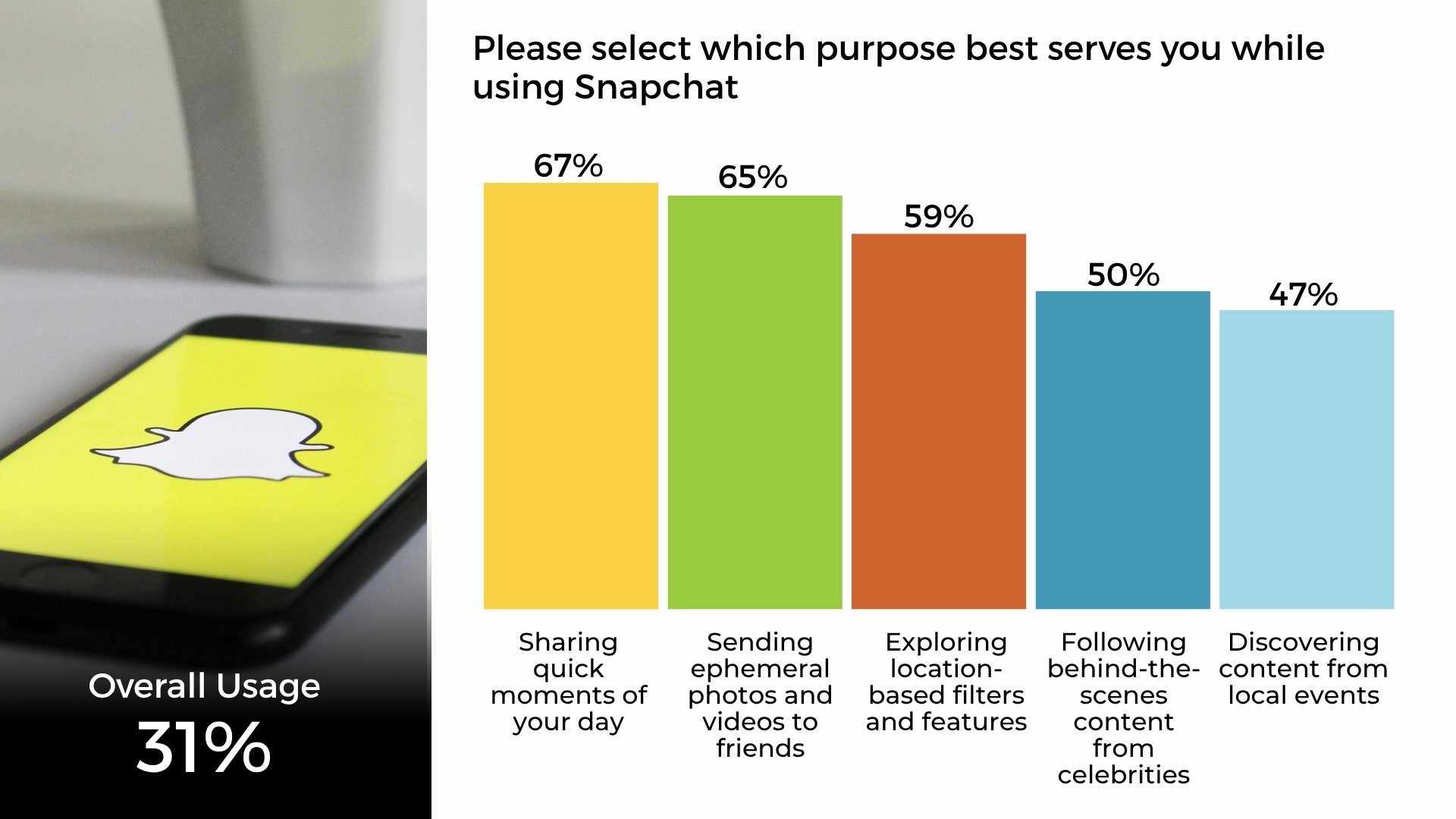

Snapchat

Snapchat is widely used for sharing spontaneous and visual content, with 67% of users using it to share quick moments of their day and 65% sending ephemeral photos and videos to friends. The platform’s unique appeal is further reflected in the 59% who enjoy exploring location-based filters and features. Additionally, 50% follow behind-the-scenes content from celebrities, while 47% use Snapchat to discover local event content, emphasizing its localized, real-time, and playful communication style.

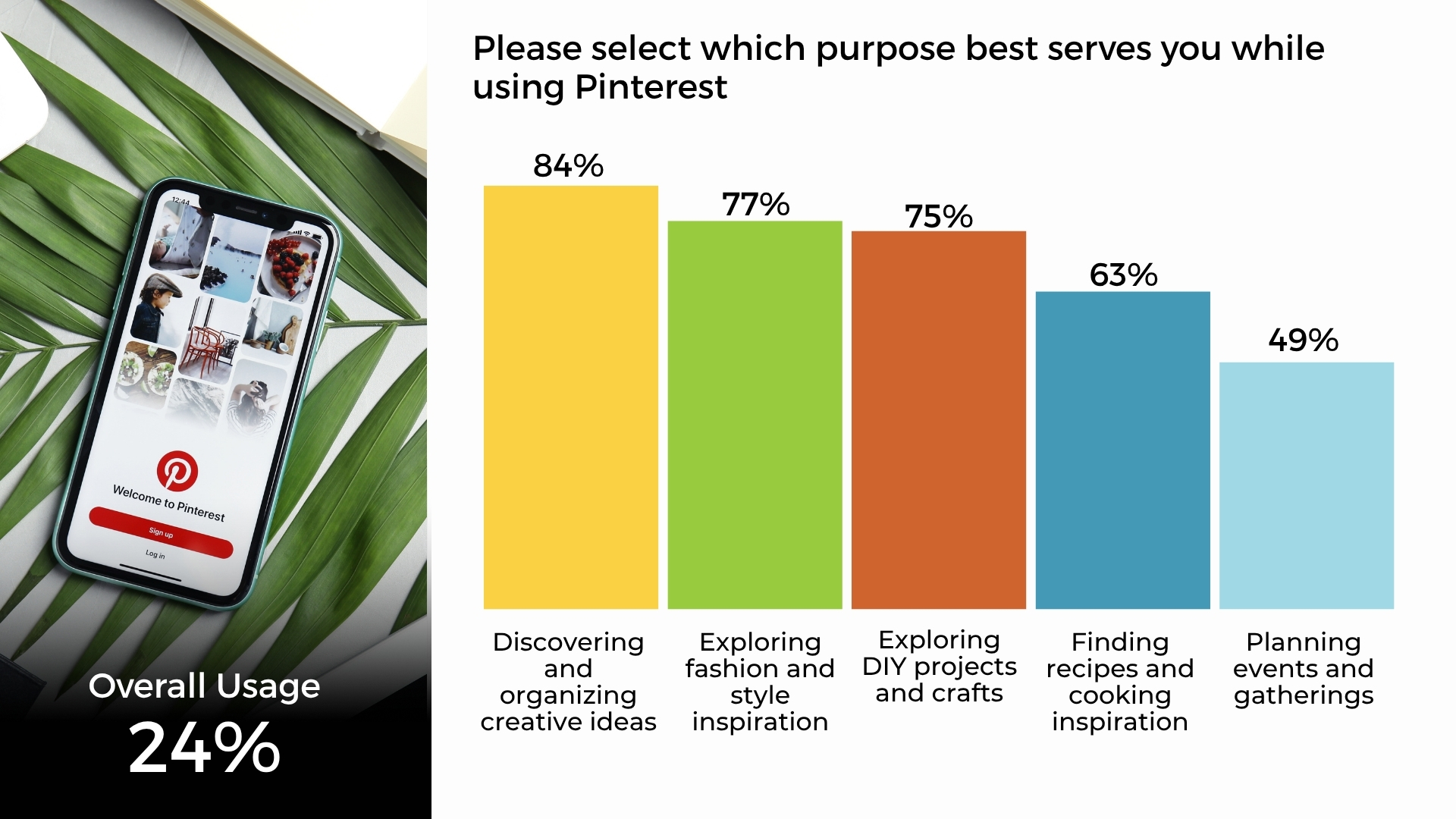

Pinterest is a go-to platform for creativity and inspiration, with 84% of users using it to discover and organize creative ideas. It is also popular for fashion and style inspiration (77%) and DIY projects and crafts (74%), highlighting its appeal to visually driven, hands-on users. Additionally, 63% turn to Pinterest for recipes and cooking ideas, while 50% use it for planning events and gatherings, reinforcing its role as a practical tool for both everyday inspiration and special occasions.

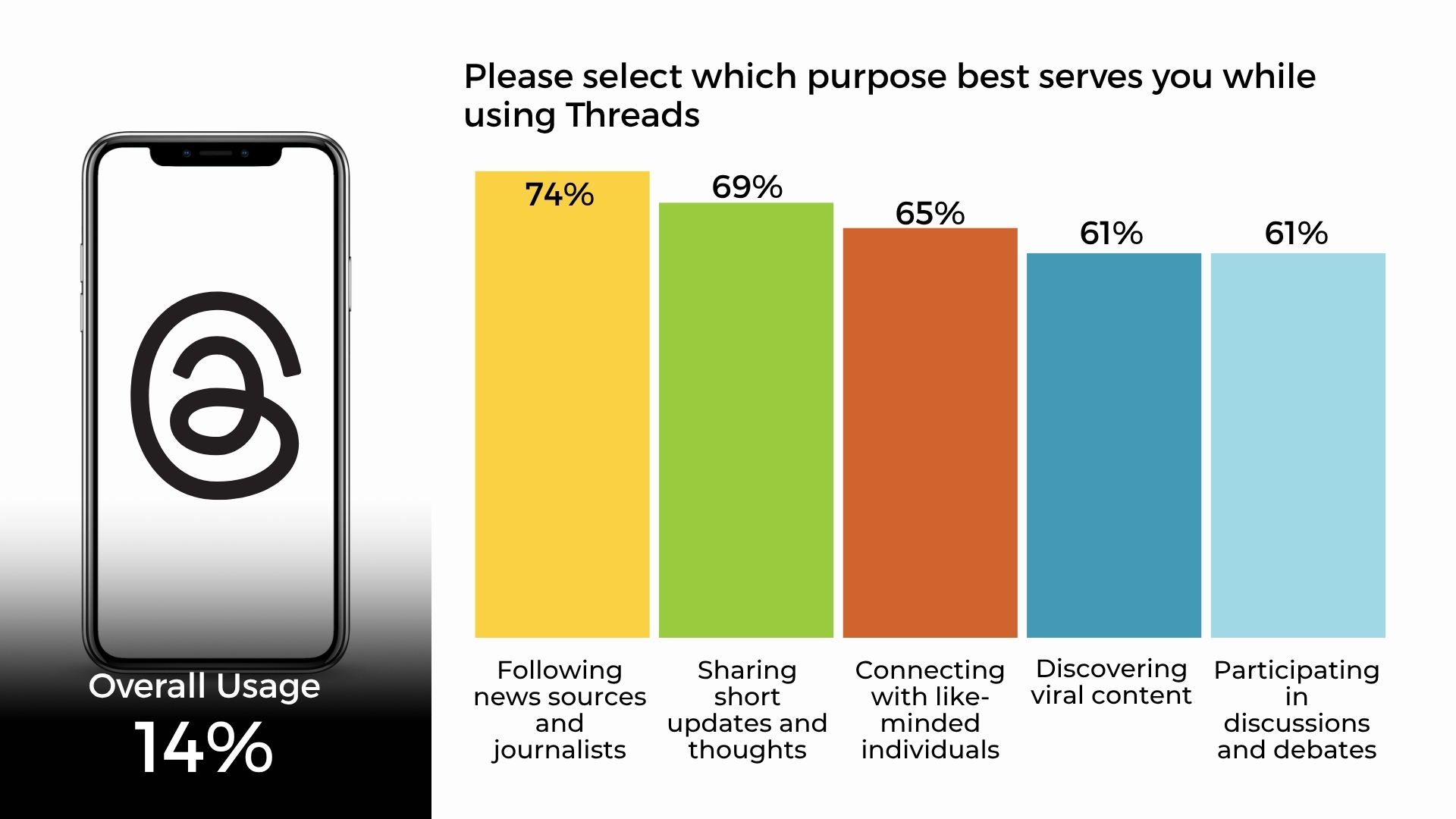

Threads

Being used by 14% of the respondents; Threads is emerging as a platform for real-time conversation and information sharing. A notable 74% of users follow news sources and journalists, while 69% use it to share short updates and thoughts. The platform also supports community engagement, with 65% connecting with like-minded individuals, 61% discovering viral content, and another 61% participating in discussions and debates. These patterns highlight Threads’ growing relevance in microblogging, timely discourse, and community interaction.

Of the 9% of respondents who use Reddit, the majority engage with the platform to discuss specific interests or hobbies (72%) and seek advice and recommendations (71%). A significant portion also participate in niche communities or subreddits (70%), and consume or share in-depth content (69%), reflecting Reddit’s strength in specialized, long-form discussions. Additionally, 63% use it to engage in debates, while 60% browse passively without active posting, highlighting a mix of active and observational user behavior.

Social media and mental health

When asked about the impact of social media on their overall well-being and mental health, the majority of respondents reported a positive experience. Specifically, 60% described the impact as very positive, while an additional 23% felt it was somewhat positive. 16% remained neutral, suggesting a balanced or mixed experience. Only a small fraction perceived any harm, with 2% indicating a somewhat negative impact and 1% reporting a very negative effect. Overall, the data suggests that most users associate their social media use with enhanced well-being and mental health.

A global analysis using nationally representative data from the 2020 Wellcome Global Monitor (among residents aged 15+ in 113 countries) found that social media use increases the risk of self‑reported generalized anxiety and depression worldwide—including in low, middle, and high‑income settings

The recent study also reveals that more than half of the respondents (53%) have taken a break from social media at some point due to its negative impact on their well-being while 48% have never paused from social media usage.

Social Media Advertisement

When asked whether they had ever purchased a product advertised on social media, a substantial 80% of respondents answered “yes”, indicating that social media plays a significant role in influencing consumer behavior. Only 20% said they had not made such purchases. This strong majority highlights the effectiveness of social media platforms as marketing and e-commerce channels, particularly in shaping buying decisions through targeted ads, influencer promotions, and engaging visual content.

Methodology/About this Survey

This Exclusive Survey was powered by GeoPoll’s AI platform; Tuucho run via the GeoPoll mobile application and Mobile web between the 22nd and 25th July 2025 in Ghana, Kenya, Nigeria, and Uganda. The sample size was 3,945, composed of random users between 18 and 50. Since the survey was randomly distributed to an affluent audiencethe results are slightly skewed towards younger respondents.

These insights highlight not only the dynamic nature of social media use across platforms, but also the power of GeoPoll in uncovering meaningful, data-driven narratives across diverse populations. Through its robust mobile-based survey technology and reach across emerging markets, GeoPoll provides fast, reliable, and actionable data that empowers organizations, brands, and researchers to understand consumer behavior, digital trends, and societal shifts in real time. As social media continues to evolve, GeoPoll remains at the forefront—bridging the gap between people and insights, and enabling smarter decisions through deeper audience understanding.

Please get in touch with us to get more details about our capabilities, explore more on various topics in Africa, Asia, and Latin America.